The growing complexity of the supply chain requires precise choices and manufacturing companies and retailers are aware of this, so much so that 80% said they had adopted advanced processes and methods such as the segmentation of the same: this is what emerges from the JDA Vision 2015 Supply Chain Market Study, a new report produced by Talant for the JDA Software Group which involved 255 business decision makers of retailers and manufacturing companies in 17 countries.

The strategies, moreover, are different and do not always use advanced technology solutions and proven best practices. “The supply chains of retailers and manufacturers have become increasingly complex, often distributed across multiple geographies, with dozens of commercial partners involved – said Kevin Iaquinto, Chief Marketing Officer of JDA -. Our report shows that, while decision makers recognise this complexity, in practice there is slow adoption of advanced technology practices and solutions to manage the challenges in key areas such as production planning and scheduling, supply chain planning and execution and demand and transport management”.

58% mentioned “the integration of Sales and Operations Planning (S&OP ) processes” as a strategic priority for the next 12 months, while 46% indicated “improvement of the agility of planning and production processes” among the strategic priorities.

Three major trends emerged from the survey.

1- Supply chain planning and execution: innovation necessary but not supported

Which are the priorities in terms of inventory management? Few doubts and nuances, given that 93% of Executives responded “Improve service levels” and 88% “Align inventory with demand”. A clear method of measuring and improving effectiveness in this area is, however, missing: respondents indicated at least 25 different parameters to evaluate performance in the inventory management area. In addition, most companies do not have advanced technology and specific tools. 59% of respondents believe that “Implementing automation” to manage inventory is a key initiative for the future. The three main objectives indicated concerning planning and execution of the supply chain are: integration of S&OP processes with the inventory planning process (indicated by 100%); improvement of the productivity of planners through improved exception management and increased automation (indicated by 93%); rationalisation of the product portfolio (indicated by 90%).

2- Demand management: frequent launches and promotions require more accurate forecasts

To meet the needs of today’s price-conscious and innovation-driven consumers, retailers and manufacturers have made significant investments to frequently launch new products and support more aggressive promotional campaigns. From the JDA survey, however, it emerges that companies do not have advanced solutions for forecasting the effects of these costly initiatives. For the launch of new products, 59% of companies surveyed do not use forecasting tools or rely on retrospective estimates developed by sales and marketing teams, and only 3% of managers interviewed indicated that their organisation uses technology to support statistical methods to forecast the results of sales promotions.

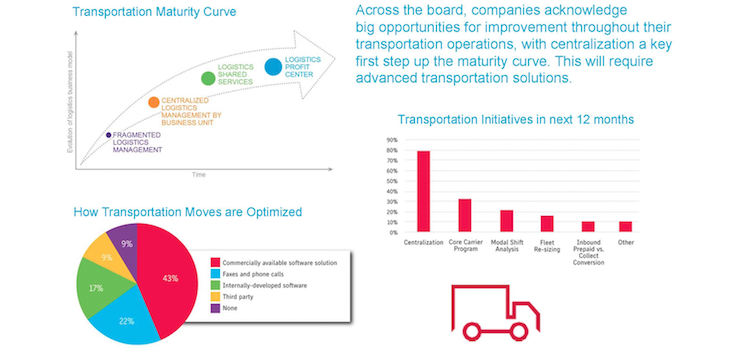

3- Transport management: lower costs through partnerships and technology

3- Transport management: lower costs through partnerships and technology

The management of transport processes represents the moment of truth in terms of profitability, yet, on average, the panel of the JDA survey indicated that 33% of orders require additional expediting actions, significantly reducing margins. A surprising number of companies employ neither advanced tools nor best practices to solve this problem. Only 26% of organisations adopt a model based on shared services for centralised management of transport and only 46% have established a carrier programme. Moreover, only 43% of companies use software solutions to optimise the management of transport processes and operations.

![foto_primotaglio_2[1]](https://www.instoremag.it/files/2015/04/foto_primotaglio_21.jpg)