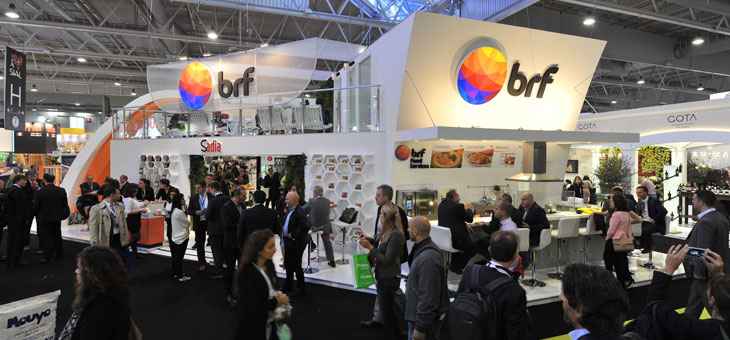

A demanding and globalised consumer with very specific tastes who increasingly demands from the food industry “easy”, fast but also tasty products, customised and localised to his tastes but with an international touch, with health needs that can no longer be ignored, needs not so much new (since new products often do not have much new to say, as can be seen from the flop of most launches on the market) but innovative products. This is the demand: the supply, on the other hand, can now come from the global market, from the big manufacturers of countries once developing but now in the global arena. This is the consumer which BRF, a name we will probably hear much of in the future, is looking towards. The seventh producer of food worldwide, based in Brazil, specialising in frozen foods, mainly fish and chicken, mostly in the form of raw materials, has in fact decided to embark on conquering the global market. With a new strategy that focuses on innovation and commercialisation of high added-value products. In Europe, one of the areas where the company intends to develop, BRF aims to become among the top five producers of frozen meat and fish, transforming itself from a supplier of standard solutions to one of custom and branded solutions, with a strong focus on quality and innovation, as explained by Marcos Delorenzo, the new Marketing Manager for Europe and Eurasia. “Europe is in fact a mature market – adds General Manager West and South Europe, Cristophe Vasseur – with consumers who want convenience and eat take away or in fast-food chains. And it is a diversified market with, in the West, chains with very strong private labels and an Eastern part where the retail offer is fragmented and private labels are still weak. In short a diversified market, to which BRF intends to propose customised solutions for both BtoB and catering chains. The new internationalisation process will be based on three pillars: brand, distribution and local production. A strategy involving acquisitions of manufacturers and distributors on the international market, but also the construction of its own facilities and development of products and marketing campaigns tailored to the various local cultures and needs. The first structure of the “new deal” will be built in Abu Dhabi at the beginning of 2015, in an emerging market with great potential.

The new products come about in a 12,500 sqm centre

The company, included by “Forbes” among the 100 most innovative in the world, focuses on research and development thanks to the BRF Innovation Center (BIC) in Jundiaí, Brazil, a 12,500 square metre complex where meat, pasta and vegetable products, but also new types of packaging, are created and tested and where 180 researchers and technicians work. It has 40 brands in its portfolio (the most important being Sadia, Perdigao, Qualy, Batavo and Elegê), which sell meat (chicken and pork), pasta, margarines, frozen pizzas and vegetables. Production, on the other hand, takes place in 58 factories, of which 47 in Brazil, 9 in Argentina and two in Europe, in the Netherlands and the United Kingdom. The 22 sales offices manage customers in 110 countries. It is the seventh food company in the world and accounts for 20% of the global poultry market. In 2013 its turnover was 9.9 billion euros. Anna Muzio