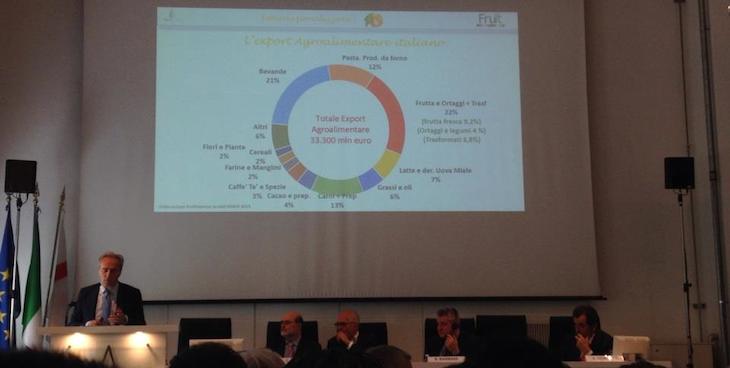

Italy is a major producer of fruit and vegetables, exporting 3.9 million tonnes (2014, +4.4%) and 4.1 million euros (-1.2%), with a share of 22% of fresh and processed produce, one point more than beverages. But how can exports be increased (also to compensate for the decline in the domestic market of 5.7% over the past 5 years) and which are the countries to be targeted? This was discussed at the seminar “Internationalisation of fruit and vegetable companies: concrete answers to emerging needs” organised by Fruit Innovation, the new fruit and vegetable exhibition which will make its debut at Fiera Milano Rho from 20 to 22 May 2015 with a mission: innovate and internationalise the industry.

Exports vary greatly depending on the product, we are the leader in the export of pears (with 718,000 tonnes, especially to Germany), stable in eating grapes of which half are exported, with the American market and seedless varieties growing, and we are the world’s second largest producer of kiwifruit (after China), 80% of which is exported to 100 countries, while we have decreased in a historical product such as citrus fruits, for which the balance of trade is negative.

The weaknesses of exports were summarised by Marco Salvi, President of Fruitimprese:

Phytosanitary barriers: if there is no bilateral agreement with the country in question, the result of political and diplomatic activity, you cannot export. In Japan, for example, we can only export processed oranges; in China we export 15,000 tonnes of kiwifruit.

The Russian embargo: fruit and vegetables have been hard hit, because it accounted for 39% of European exports, and is the largest importer of pears.

The conflicts in North Africa and the Middle East: that threaten an extremely promising and growing market.

The lack of a policy of commercial expansion involving companies and focussing promotional investments on selected markets.

Higher costs compared to other countries (including Spain, a direct competitor) in terms of labour, energy and transport.

“Companies, politics, universities and research need to form a system. 260 million euros for Made in Italy products have already been allocated by the Ministry of Economic Development (MED), which could allow us to make the quantum leap. We must invest in communication: for Pink Lady apples, for example, we invest 10 million euros a year. We are market leaders in many products, but we must avoid doing as we did for oranges, where we are the tail-end in exports: who would have said so 25 years ago?” warned Marco Salvi, President of Fruitimprese.

Claudio Scalise, Managing Partner of SGMARKETING, on the other hand, identified the opportunities to be seized at this point in time, positive due to the favourable euro/dollar exchange rate, oil prices at all-time lows and the beginning of recovery in consumption. “Among the trends I see are the increasingly blurred distinction between fresh and processed produce (see ready-prepared fresh produce) and exports that think in terms of the supply chain, from manufacturer to distributor to processor”. Another crucial lever is adaptation of the strategy to the different markets which request different things: critical consumption, service and aesthetics for mature markets, so product presentation becomes of crucial importance; quality standards, brand and service for emerging markets, for which imported fruit and vegetables are a status symbol for the middle class; and price for “New Frontier” countries (Africa, India, Turkey, Middle East), where fruit and vegetables are a commodity.