After France, even Europe could come to pass a law to force large-scale distribution to take care of food products discarded because, for various reasons, they are unsellable. But many European retailers have long since embarked on internal initiatives and awareness campaigns to address the issue. An overview of the actions put in place in the field is made – with a wealth of case histories – by the 2014 “Retail Agreement on Waste” report by Eurocommerce, which includes the trade associations of the Old Continent, and European Retail Round Table.

In 2012, 20 retailers from various segments, from clothing to food, from furnishings to consumer electronics, adhered to the Retail Waste Agreement, pledging, by the middle of 2014, to put in place at least two awareness campaigns against waste addressed to the end customer. Recently, another six retailers signed the same agreement. The initiative took place within the Retailers’ Environmental Action Programme (REAP) supported by the European Commission.

Below are the types of initiatives put in place and the segments covered. The full report can be downloaded here.

Consumer “Tips”. Recipes for using leftovers, information on how to manage the cold chain (starting with, simply, as El Corte Inglès does, how to transport frozen food from the store to the home, how to arrange food in the fridge and how long it lasts once opened), through leaflets, house organs, social media or in-store posters. Asda last year launched the Simply Roast in the Bag packaging, a bag for roast chicken on which recipes and tips on how to use the leftovers were printed, and a QR Code which referred to the website with videos and recipes. Albert Heijn distributed a million “measuring cups” to dose the right amount of pasta and rice. The Dutch Vak Centrum invites customers to take fresh produce with the closest expiry date if they know they will use them in a short space of time; the habit of selecting the product with the longest expiry date increases waste.

How to educate the supplier. Carrefour France has created an award for the most virtuous supplier. The jury is composed, in addition to retailers, of the Ministry of the Environment, WWF and a pool of journalists.

Sustainable promotions. The classic 2 for the price of 1 promotions have been put on trial because they lead consumer to buy more, increasing the risk of waste, especially of food with expiry date. Some chains have decided to ban them. Auchan in French hypermarkets has taken a third route: “deferred” two for the price of one. For one week a month, when buying the first product, the customer gets a voucher to pick up the second a week later. Of the 100,000 of coupons distributed each month half are used.

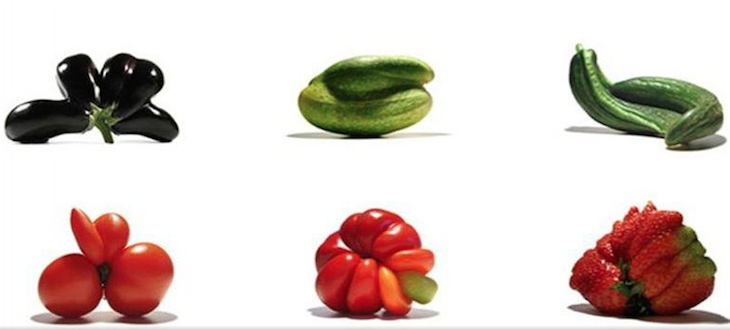

Ugly but good. Billa in Germany has created the “Wunderlinge” brand for fruit and vegetables with strange shape but perfectly good.

Circular economy. That is, what is produced is recycled and reused. Lidl in Germany recycles 50% of PET bottles of its Saskia and Freeway brands. Rewe is increasing the percentage of plastic recycled and withdraws on site the packaging of Frosch-Cleaning products. The Dutch restaurant Instock uses unsellable products (imminent expiry dates, damaged packaging) picked with electric vehicles from Albert Heijn supermarkets. Since last summer, it has already “saved” 20,000 portions.

Packaging counts. Coop Denmark has decided to sell bananas individually because the pack, even if it contains only one marked banana, as often happens, is not purchased, and six thousand bananas a day were thrown away. Coop UK has discovered that the holes in the packaging of fresh produce to reduce internal humidity, if managed by a laser guided by a computer, allow the shelf life to be extended by one day with a consequent reduction in waste. Coop Norway has indicated on bags and packs the percentage of waste of fruit and vegetables, but also in packaged food the waste of that particular product.

Packaging counts. Coop Denmark has decided to sell bananas individually because the pack, even if it contains only one marked banana, as often happens, is not purchased, and six thousand bananas a day were thrown away. Coop UK has discovered that the holes in the packaging of fresh produce to reduce internal humidity, if managed by a laser guided by a computer, allow the shelf life to be extended by one day with a consequent reduction in waste. Coop Norway has indicated on bags and packs the percentage of waste of fruit and vegetables, but also in packaged food the waste of that particular product.

Raising staff awareness. 75% of employees in the Carrefour head office in Poland have followed a program on how to reduce energy consumption at home and at work.

Learning while playing: quizzes, games, contests. Carrefour has put on line a questionnaire to determine energy consumption: the first drawn won an energy-efficient dishwasher. Ikea in the Czech Republic has invited customers to create objects out of waste material. The creators of the best projects participated in a course held by professional designers. The proceeds from the sale of the items went to charity. Many courses and competitions involve schools.

Learning while playing: quizzes, games, contests. Carrefour has put on line a questionnaire to determine energy consumption: the first drawn won an energy-efficient dishwasher. Ikea in the Czech Republic has invited customers to create objects out of waste material. The creators of the best projects participated in a course held by professional designers. The proceeds from the sale of the items went to charity. Many courses and competitions involve schools.

How to educate the supplier. Carrefour France has created an award for the most virtuous supplier. The jury is composed, in addition to retailers, of the Ministry of the Environment, WWF and a pool of journalists.

Sustainable promotions. The classic 2 for the price of 1 promotions have been put on trial because they lead consumer to buy more, increasing the risk of waste, especially of food with expiry date. Some chains have decided to ban them. Auchan in French hypermarkets has taken a third route: “deferred” two for the price of one. For one week a month, when buying the first product, the customer gets a voucher to pick up the second a week later. Of the 100,000 of coupons distributed each month half are used.

Ugly but good. Billa in Germany has created the “Wunderlinge” brand for fruit and vegetables with strange shape but perfectly good.

Circular economy. That is, what is produced is recycled and reused. Lidl in Germany recycles 50% of PET bottles of its Saskia and Freeway brands. Rewe is increasing the percentage of plastic recycled and withdraws on site the packaging of Frosch-Cleaning products. The Dutch restaurant Instock uses unsellable products (imminent expiry dates, damaged packaging) picked with electric vehicles from Albert Heijn supermarkets. Since last summer, it has already “saved” 20,000 portions.