The new edition of the GEA–Fondazione Edison Observatory records that in 2013 Italian food represented an important driver in export growth.

On a base of reference of 616 products, in fact, Italy has 63 products in which it gains first, second or third place in the world for best foreign balance of trade, generating a total of 21.5 billion dollars.

Together, the ‘4 As’ of Made in Italy (Alimentari-vini/food-wine; Abbigliamento-moda/clothing-fashion; Arredo-casa/furnishings-home; Automazione-meccanica-gomma-plastica/Automation-mechanical-rubber-plastics) confirm a positive growth reaching a new record of 128 billion euros.

From an analysis of the data what emerges, furthermore, is that the United States is the third-largest export market for Italy, after Germany and France, with overall Italian exports to the USA of 29.8 billion euros and a surplus of 17.3 billion, the highest Italy had in 2014 in bilateral trade.

The American market, in particular, is increasingly focalised on the food sector and this presents the greatest potential for growth; suffice to consider that in 2014, about 10% of Italian exports were to the American market. The first 10 provincial-sectorial examples of highest food exports towards the USA in 2014 are: Florence, Lucca, Grosseto, Milan and Perugia for oils and vegetable & animal fats; Modena for other food products; Naples for baked and flour products; Salerno for fruit and veg that have been prepared and conserved; Sassari and Parma for the products of the dairy industries. The first 10 provincial-sectorial examples of highest wine and drink exports towards the USA in 2014 are: Trento, Milan, Cuneo, Florence, Verona, Siena, Venice, Treviso, Asti and Brescia. In total, 61 agriculture and food products in which Italy came first, second or third in the world for best balance of trade with the USA, for a bilateral commercial surplus of 3.3 billion dollars.

The increasingly strong relationship between the US market and Italian food has been confirmed by a GEA Digital study. From this, which focused on the feelings towards food, and Italian food in particular, expressed by consumers throughout the world and the USA through web traffic, what emerged is that the number of searches relating to food from US users is three times higher than the rest of the world and that Italian food beats other online topics such as Italian art and music.

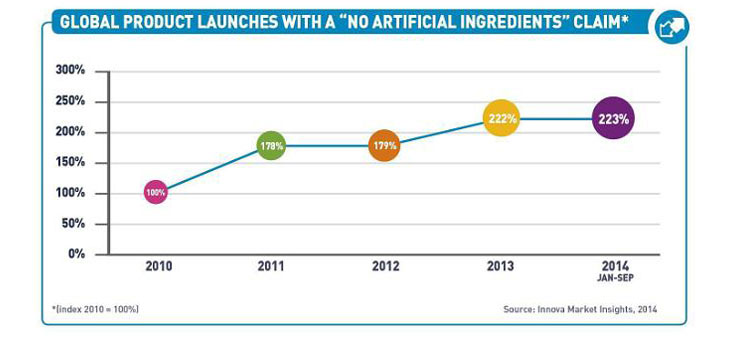

Starting from an awareness of the enormous potential of Italian food in the USA, Luigi Consiglio, President of GEA (in the photo) , comments: «The data and trends demonstrate that interest in Italian food throughout the world is very strong, in particular in the United States, an extremely lively market, where the demand expresses the expectation of healthier food. Today anyone who says the US market is saturated is wrong. The opportunities for Made in Italy are there and there is a lot of space for all the food and agricultural industries who wish to export and invest in the USA. The political battle that has been fought up to now has not allowed us to see the wonders of our industrial system. For this reason GEA, along with the Harvard Business Review Italia, wanted to overcome the stereotypes about Italian industry through the creation of an annual overview of the entrepreneurial excellences of Italy».

Thus was conceived the GEA-Harvard Business Review Italia “Business Excellence” Prize, which will be awarded for the second time on 27 October 2015.