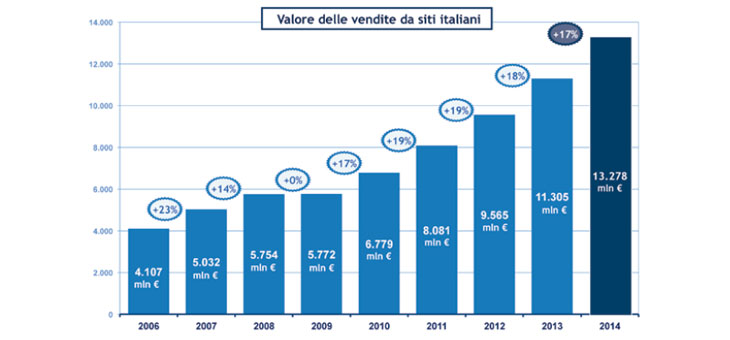

E-commerce continues to grow in Italy. According to the Digital Innovation Observatory of the Politecnico di Milano – Netcomm this year online sales will reach 13.3 billion euros, +17% compared to 2013. It would seem that, after years of fear and uncertainty about online payments and “virtuality” of goods that cannot be seen or touched, Italians (or at least 16 million of them) have finally succumbed to the attraction (or the convenience and affordability) of online shopping

Increasingly Mobile Commerce

From the dawn of the “mobile phone”, Italians have been great fans and owners, reaching the top of the world rankings. But they didn’t use it for the more advanced features (except for a number of few and far between early adopters). Now everything has changed, and after having downloaded games, fitness, budget management and social Apps, the smartphone is also used for shopping. So much so that in 2014 Mobile Commerce has doubled, with 1.2 billion euros in sales which, together with those via Tablets, count for 20% of total e-commerce.

From the dawn of the “mobile phone”, Italians have been great fans and owners, reaching the top of the world rankings. But they didn’t use it for the more advanced features (except for a number of few and far between early adopters). Now everything has changed, and after having downloaded games, fitness, budget management and social Apps, the smartphone is also used for shopping. So much so that in 2014 Mobile Commerce has doubled, with 1.2 billion euros in sales which, together with those via Tablets, count for 20% of total e-commerce.

Comparison with the physical store

What are the consequences for “traditional” retailers? Let’s start with the numbers: in value, e-commerce will increase this year from 2.6 to 3.5% of total retail sales and market penetration will increase especially in certain sectors such as Publishing (from 4 to 7%), IT (from 7.5 to 10.5%) and Clothing (from 2.9 to almost 4%). Taking the lion’s share are the Dot Coms such as Amazon, eBay and Expedia which alone generate more than half of the entire growth (22% compared to 2013) but also Privalia, Booking.com and the Italian Banzai and YOOX. They account for 54% of the value of online sales and, if we consider only products, excluding services, their share increases to 70%. And the weight of traditional producers and retailers is reduced to 14%. Not only: there are 1000 new start ups, of which 54 Italian, especially in Clothing, Furniture and Design and Food & Wine. According to Alessandro Perego, Scientific Director of the e-Commerce B2C Observatory of the Politecnico di Milano and Netcomm. “This percentage highlights the weaknesses of the traditional players (producers and retailers) which are still struggling to interpret online as a real alternative channel and that is why they are unable to play a leading role, as is the case in many Western markets. Despite more than 30 new online entries among traditional players in the various market sectors, we very often see a half-hearted approach. In our opinion, the strategy should be to design integrated multichannel approaches, aimed at exploiting to the utmost the real differentiator of traditional players, i.e. the store. In this context, also the Smartphone will have an increasingly significant role in uniting the physical and digital worlds”. A hybrid milieu in which the new “Super consumer” moves with ease, passing from real to virtual, perhaps buying online from the interactive display or touch screens in the store. Not forgetting that the web now influences one in four traditional purchases.

Food & Wine is growing, Grocery still a niche

In 2014, the percentage of large-scale distribution brands with an e-commerce site in the non-food sector increased to 55% (from 53% in 2013) and in the food sector to 10% (8% in 2013). Grocery has taken some timid steps forward, with a total market value of 160 million euros (+18%), but the incidence on total retail sales is still absolutely negligible (0.1%). Still in its infancy we might say. And yet the online potential is certainly there. Some hitherto insignificant sectors are emerging, such as gourmet Food & Wine (Eataly immediately springs to mind), with more than 200 million euros in sales in 2014 (+30%) and with huge potential also in digital exports. Furniture (130 million euros, +100%) and Perfumery and Cosmetics (40 million euros, +25%) are also doing well.

Comparison with others

In the last year, in Italy, online shoppers exceeded 16 million, 10 million of whom made at least one purchase per month and generated 90% of sales. The average annual expenditure is approximately € 1,000, in line with the main European e-commerce markets (with the exception of the UK, which spends twice as much). The biggest values(see table) are therefore due to the number of e-customers: in the UK there are 39 million web shoppers, in Germany 44 and in France 29 million. Anna Muzio

In the last year, in Italy, online shoppers exceeded 16 million, 10 million of whom made at least one purchase per month and generated 90% of sales. The average annual expenditure is approximately € 1,000, in line with the main European e-commerce markets (with the exception of the UK, which spends twice as much). The biggest values(see table) are therefore due to the number of e-customers: in the UK there are 39 million web shoppers, in Germany 44 and in France 29 million. Anna Muzio