The Top 10 Trends likely to impact the food industry in 2015 and beyond have been identified by Innova Market Insights from its ongoing analysis of key global developments in food and drink launch activity worldwide.

“The move from ‘clean’ to ‘clear’ labeling is a key trend for 2015, reflecting a move to clearer and simpler claims and packaging for maximum transparency,” reports Lu Ann Williams, Director of Innovation at Innova Market Insights. “Meeting the needs of the Millennial consumer has also become a key focus, as has targeting the demands of the gourmet consumer at home, re-engineering the snacks market for today’s lifestyles and combating obesity with a focus on positive nutrition.”

Top food and beverage trends for 2015 are led by:

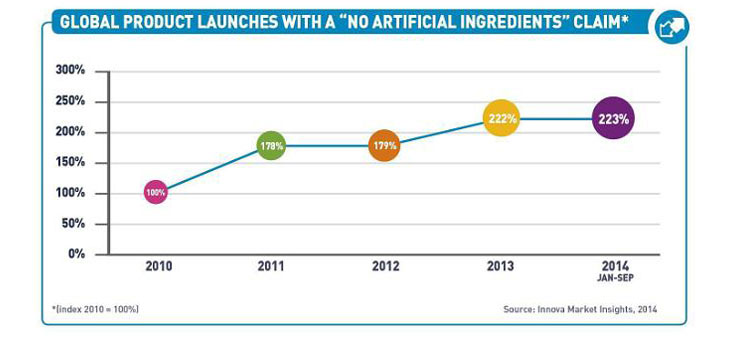

1. From Clean to Clear Label. Clean label claims are tracked on nearly a quarter of all food and beverage launches, with manufacturers increasingly highlighting the naturalness and origin of their products. With growing concerns over the lack of a definition of “natural,” however, there is a need for more clarity and specific details. Consumers, retailers, industry and regulators are all driving more transparency in labeling.

2. Convenience for Foodies. Continued interest in home cooking has been driven by cooking shows on TV and by blogging foodies. It is seen as fashionable, fun and social, as well as healthy and cost-effective. It has driven demand for a greater choice of fresh foods, ingredients for cooking from scratch and a wider use of recipe suggestions by manufacturers and retailers.

3. Marketing to Millennials. The so-called Millennial generation, generally aged between 15 and 35, now accounts for about one-third of the global population and is tech savvy and socially engaged. They are well informed, want to try something different and are generally less brand loyal than older consumers. They want to connect with products and brands and know the story behind them.

4. Snacks Rise to the Occasion. Formal mealtimes are continuing to decline in popularity and growing numbers of foods and drinks are now considered to be snacks. Quick healthy foods are tending to replace traditional meal occasions and more snacks are targeted at specific moments of consumption, with different demand influences at different times of day.

5. Good Fats, Good Carbs. With concerns over obesity there is a growing emphasis on unsaturated and natural fats and oils that has seen rising interest in omega 3 fatty acid content as well as the return of butter to favor as a natural, tasty alternative to artificial margarines that may be high in trans fats. In the same way, naturally-occurring sugar is being favored at the expense of added sugars and artificial sweeteners.

Innova Market Insights will present the Top 10 Trends at Hi Europe, Amsterdam, booth no. G40 (Ingredients in Action), December 2-4.