Flyers and coupons, the backbone of promotional communication of large-scale distribution, are about to undergo a revolution. Which mainly concerns their dematerialisation and digitalisation. But that’s not all. Because the switch to digital will allow retailers, for example, by connecting to the loyalty card and through the analysis of Big Data, to avoid “shooting at random” and offer customised promotions and discounts, tailored to the needs, tastes and habits of the individual.

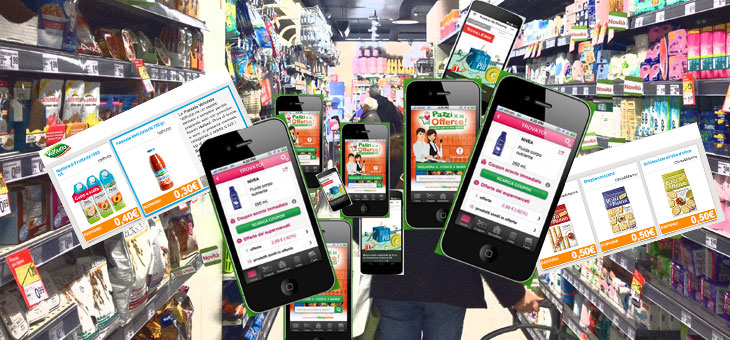

While at the moment, communication via text messages remains the main channel, especially in the engagement phase, much is already being done, and much will be done during the course of this year in terms of dematerialisation. Because the benefits are numerous, and everybody is asking for it. First of all Mobile consumers, the vast majority of whom prefer to receive Mobile Coupons, increasing from 76% in 2013 to 88% in 2014. And the reasons are also changing somewhat: while still practical and convenient, there is an increase in the demand for customisation and the propensity to use them in the store, increasingly a place where real and virtual intersect and integrate, but also the social dynamics. Consumers prefer Apps that aggregate different offers (even though there is a decrease according to the Doxa/Observatory survey from 76% in 2013 to 73% in 2014) because they provide the possibility to instantly compare the proposals, but the percentage of those who prefer the App of their favourite store is increasing (from 24 to 27%) because it allows customisation and additional services.

Then on the retailer side, experimentation is already underway, at different speeds. Both proprietary Apps as well as third-party wallets, coupon aggregators, are used. The phases to be considered are reading, redemption and clearing; reading can be via QR code, typing or check-in at the till, the coupon can be virtualised on the physical loyalty card or using contactless technologies or an image scanner.

The brand industry is extremely interested. Among the benefits envisaged are acquisition of customer information, cost reduction, offer customisation and fraud reduction. In addition, there is the possibility to verify the campaign results more rapidly and possibly make corrections on the fly.

“Brands are waiting for the retailers. Which have various problems to solve – explains Marta Valsecchi, head of research at the Mobile Marketing & Service Observatory of the Politecnico di Milano – of a structural nature (the economic situation, national or local extension, size, etc.), regarding the choice of the most effective channel for distributing coupons (proprietary App or third party wallet, or a combination of the two) and with regard to reading and redemption systems, which must be enabled. Technological replacement is on the move, also driven by the need to in any case replace obsolete terminals, but it should be part of a broader strategy. The real quantum leap will come with the adoption of a CRM approach, in order to build a single view of the consumer along the entire purchasing chain. There is a lot going on, with various experiments in a number of stores: let’s see what the consumer response will be”.

The digital flyer: already read by 5 million Italians

According to a Nielsen survey, 20 million households receive supermarket flyers and 12 million read them regularly. The online flyer is now read by about 5 million people, half of which only on Mobile devices. “The numbers are starting to become significant – says Marta Valsecchi -. And Mobile is becoming a new communication medium.

Not only: users browse the flyer both outside (30%) as well as inside (17%) the store. Then there are those who aggregate flyers, very popular with users and which have also become a new means of communications in which to invest”. The flyer in the store app is very widespread (72%) although not reaching the levels of consumer electronics (100%). Also in this area, therefore, there is much to be done.